Get the free CERTIFICATE OF ASSUMED BUSINESS NAME - Madison County ...

Show details

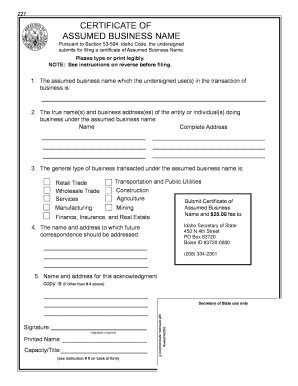

For persons (sole proprietorship; associations; or general partnerships) engaged in business under a name other their own (DBA) CERTIFICATE OF ASSUMED BUSINESS NAME STATE OF INDIANA, COUNTY OF. NAME

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your certificate of assumed business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of assumed business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of assumed business online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certificate of assumed business. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out certificate of assumed business

How to fill out a certificate of assumed business:

01

Gather the necessary information: Make sure you have all the required details such as the name of your business, the address, and the type of business you are operating.

02

Download the appropriate form: Visit the relevant government website or contact your local business authority to obtain the certificate of assumed business form. It is usually available in a downloadable format or can be obtained in person.

03

Fill in your business information: Start by entering your business name exactly as you intend to operate it. Provide the complete address of your business location, including the street, city, state, and ZIP code.

04

Specify the type of business: Indicate the nature of your business. You may have options to select from, such as sole proprietorship, partnership, or limited liability company (LLC). Choose the appropriate option that aligns with your business structure.

05

Provide additional details: Depending on the requirements of your jurisdiction, you may need to provide additional information such as your social security number or employer identification number (EIN). Fill in these details accurately.

06

Review and sign: Take a moment to review all the information you have entered on the form. Ensure that there are no errors or omissions. Once you are satisfied, sign and date the certificate of assumed business in the designated fields.

Who needs a certificate of assumed business:

01

Individuals starting a sole proprietorship: If you are operating a business under your own name or a fictitious name, you may need a certificate of assumed business. This document helps establish your business identity and enables you to legally operate under a different name than your own.

02

Partnerships: If you are starting a business with one or more partners, it is essential to obtain a certificate of assumed business. This certificate ensures that your business, operating under a partnership name, is recognized by the relevant authorities.

03

Some states or jurisdictions may require other business types: Depending on your location and the nature of your business, certain states or jurisdictions may have specific requirements for other business structures. It is important to check with the appropriate government agencies to determine if you need a certificate of assumed business for your specific situation.

Note: The specific requirements for a certificate of assumed business may vary depending on your jurisdiction. It is always recommended to consult with a legal professional or the relevant government authorities to ensure compliance with all applicable rules and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is certificate of assumed business?

A certificate of assumed business, also known as a certificate of assumed name or a fictitious name certificate, is a legal document that allows a business to operate under a name other than its legal name. This certificate is typically required by state or local governments when a business chooses to use a trade name or DBA ("doing business as") name that is different from the name of the business owner or the entity's registered name. The purpose of this certificate is to provide transparency and prevent fraudulent activities by ensuring that customers and the public can identify the true identity of the business.

Who is required to file certificate of assumed business?

The requirement to file a certificate of assumed business may vary depending on the jurisdiction and the specific business type. Typically, sole proprietors, partnerships, and sometimes corporations or limited liability companies (LLCs) that operate under a different name than the legal name of the individual or entity are required to file a certificate of assumed business or fictitious business name statement. These certificates inform the public about the true owner(s) of the business and are often filed with the county or state where the business operates. It is important to check with the local government or a business attorney to determine the specific requirements in a particular jurisdiction.

What is the purpose of certificate of assumed business?

The purpose of a certificate of assumed business (also known as a fictitious name certificate, trade name certificate, or DBA certificate) is to allow a business to operate under a name other than its legal name.

In many jurisdictions, businesses are required to register their business name with the appropriate government agency, commonly the Secretary of State's office or the county clerk's office. This allows the government and public to know the true identity of the entity behind a particular business name.

When a business wants to operate under a name that is different from its legal name, it is often required to file a certificate of assumed business. This certificate serves as a public record, declaring that the business is using a fictitious or assumed name for its operations.

The purpose of requiring a certificate of assumed business is to prevent fraud and maintain transparency in business transactions. It helps protect consumers and other stakeholders by ensuring that they can identify and connect a business with its legal entity.

Additionally, the certificate of assumed business may be necessary to open bank accounts, obtain business licenses, enter into contracts, and engage in other business activities under the assumed name.

It's important to note that the specific requirements and regulations surrounding certificates of assumed business can vary by jurisdiction. Business owners should consult their local government authorities or legal advisors for accurate and up-to-date information.

What information must be reported on certificate of assumed business?

The information that must be reported on a certificate of assumed business can vary depending on the jurisdiction. However, some common information that may be required includes:

1. Name of the assumed business: The name under which the business intends to operate.

2. Legal name and address of the business owner(s): The legal name and address of the individual(s) or entity that owns the business.

3. Business address: The physical address of the business, where it will be located.

4. Nature of business: A brief description of the type of business or industry the assumed name will be associated with.

5. Effective date: The date on which the assumed business name will become effective.

6. Duration of assumed name: The duration for which the assumed name will be used. It may be perpetual or for a specific period of time.

7. Filing fee: The appropriate filing fee for registering the assumed business name.

It's important to note that this is a general list and the specific requirements can differ depending on local laws and regulations. It's advisable to consult with the relevant local government agency or an attorney to ensure that all necessary information is included on the certificate of assumed business.

What is the penalty for the late filing of certificate of assumed business?

The penalty for the late filing of a Certificate of Assumed Business name can vary depending on the jurisdiction. In some states, there may be a flat fee for late filing, while in others, the penalty may be calculated on a daily basis.

For example, in California, if a business fails to file the required statement within 40 days from the date of conducting business under the assumed name, a penalty of $250 may be imposed. Additionally, there may be further penalties for every 30-day period of continued non-compliance.

It is important to consult the specific regulations and requirements of the relevant state or local government agency to determine the exact penalty for the late filing of a Certificate of Assumed Business name in a particular jurisdiction.

How do I modify my certificate of assumed business in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your certificate of assumed business and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit certificate of assumed business in Chrome?

certificate of assumed business can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the certificate of assumed business electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your certificate of assumed business in minutes.

Fill out your certificate of assumed business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.