AZ DOR 82162 2019-2024 free printable template

Show details

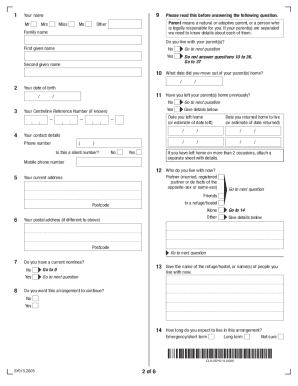

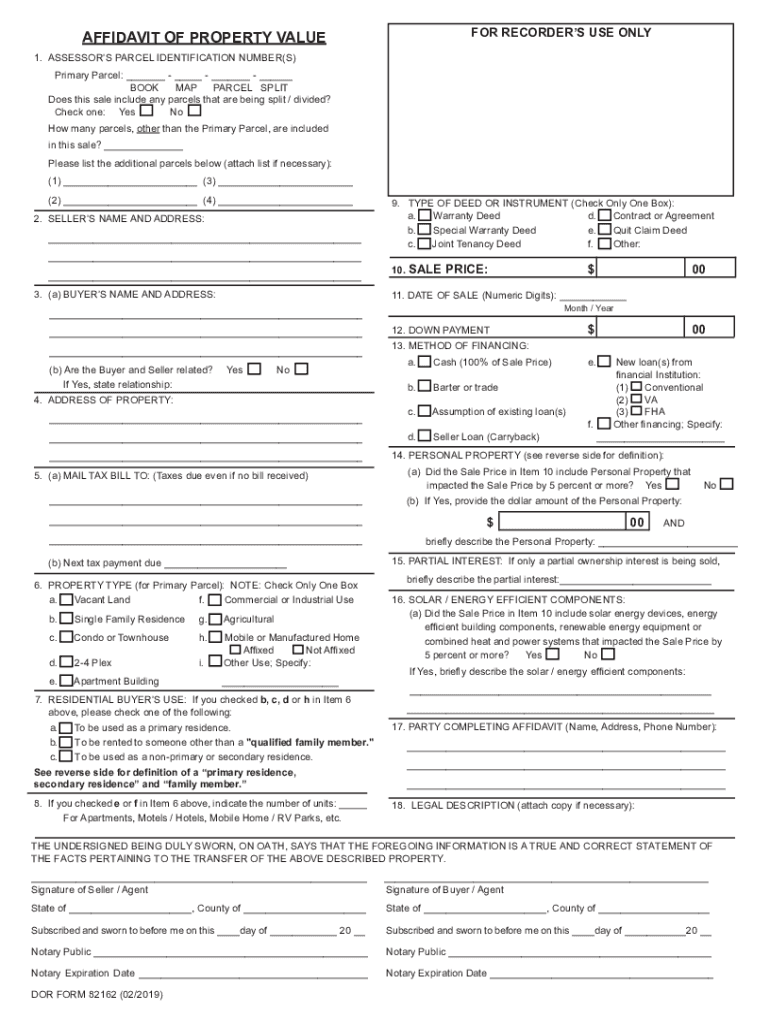

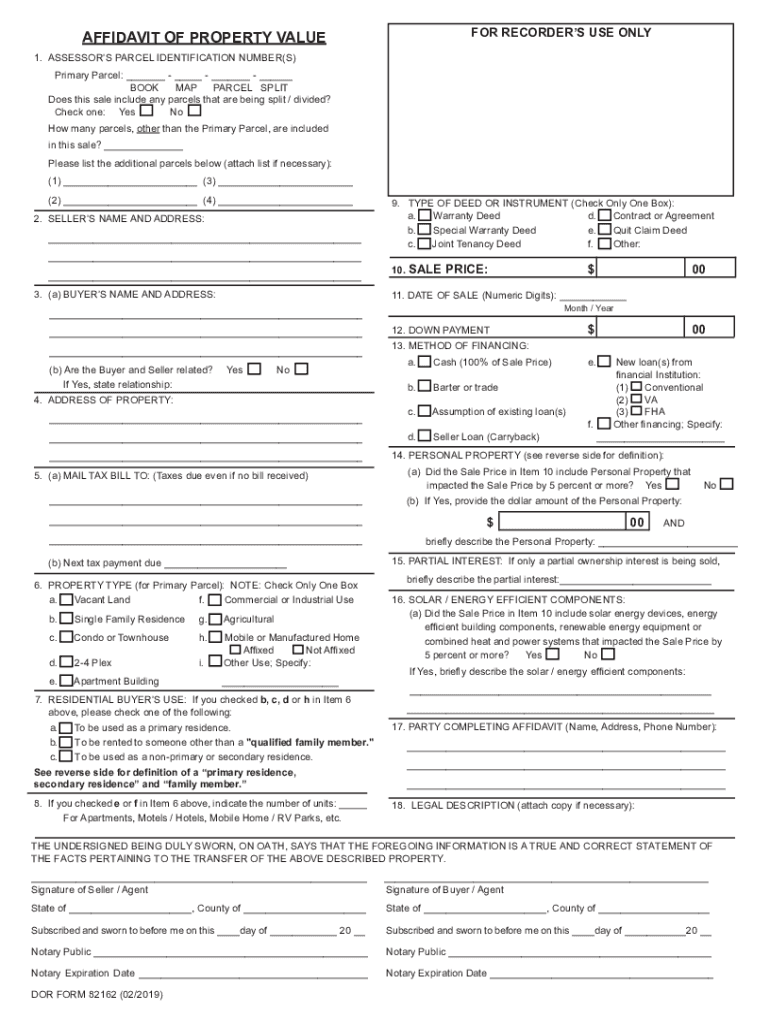

Print Clear Form FOR RECORDER S USE ONLY AFFIDAVIT OF PROPERTY VALUE 1. ASSESSOR S PARCEL IDENTIFICATION NUMBER(S) Primary Parcel: - - - BOOK MAP PARCEL SPLIT Does this sale include any parcels that

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your az revenue 2019-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your az revenue 2019-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit az revenue online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit arizona revenue form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

AZ DOR 82162 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out az revenue 2019-2024 form

How to fill out az revenue:

01

Gather all necessary tax forms and documents, such as W-2s, 1099s, and receipts.

02

Review instructions for each form to ensure accurate completion.

03

Fill in personal information such as name, address, and social security number.

04

Report all income sources and amounts accurately.

05

Deduct applicable expenses and eligible credits to reduce taxable income.

06

Calculate the amount owed or the refund due.

07

Sign and date the completed forms and attach any required schedules or supporting documentation.

08

Submit the forms by mail or electronically, as instructed by the Arizona Department of Revenue.

Who needs az revenue:

01

Individuals who live or work in Arizona and meet the state's tax filing requirements.

02

Business owners or self-employed individuals who conduct business within the state.

03

Arizona residents who earn income from sources outside the state and need to report it for tax purposes.

Fill az affidavit property : Try Risk Free

People Also Ask about az revenue

Who determines the value of your property for the purposes of taxation in Arizona?

How much are transfer taxes in AZ?

What is an Affidavit of property value Arizona?

Do I need Affidavit of property value in Arizona?

What is the Arizona Affidavit of Disclosure?

Is there a transfer tax on real property in Arizona?

What is the difference between full cash value and limited property value in Arizona?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is az revenue?

Az Revenue is the total amount of money a company earns from its operations over a given period of time. It is typically a measure of a company's profitability.

How to fill out az revenue?

If you need to file a tax return with the Arizona Department of Revenue, you can do so online through their website. To fill out the form, you will need your Social Security number, income, deductions, and other pertinent information. You can also use the online Taxpayer Service Center to view your tax history and make payments.

Who is required to file az revenue?

Individuals and businesses who earn income in the state of Arizona are required to file Arizona Revenue taxes. This includes residents of Arizona, non-residents who earn income in Arizona, and individuals or businesses with Arizona source income.

What is the purpose of az revenue?

The purpose of AZ Revenue is to collect and manage tax revenue for the state of Arizona. It serves as the department responsible for administering and enforcing tax laws, ensuring compliance, and collecting taxes from individuals and businesses. The revenue collected by AZ Revenue is used to fund state government operations, public services, infrastructure projects, education, healthcare, and other essential programs.

What information must be reported on az revenue?

When reporting Arizona revenue, the following information must be included:

1. Gross receipts: The total amount of revenue generated from all sales, services rendered, or any other business activities before deducting any expenses or taxes.

2. Sales tax collected: The amount of sales tax collected and owed to the state of Arizona on taxable sales. This includes both transaction privilege tax (TPT) and use tax collected, if applicable.

3. Net income: The amount derived from subtracting all allowable business expenses from gross receipts. It represents the profit or loss generated by the business during the reporting period.

4. Any non-operational revenue: Any income earned from sources other than the primary business operations, such as rental income, interest earned, or investment gains.

5. Tax exemptions or deductions: Any exemptions or deductions claimed for specific types of income, such as sales to out-of-state customers or specific industries with exemptions.

6. Any adjustments or reconciliations: Any adjustments or reconciliations made to the reported revenue or expenses, such as correcting errors, reclassifications, or removing non-taxable transactions.

It is important to consult the Arizona Department of Revenue or a tax professional for specific reporting requirements and any updates or changes to the state's revenue reporting guidelines.

What is the penalty for the late filing of az revenue?

The penalty for the late filing of Arizona state revenue is typically 1% per month of the unpaid tax, up to a maximum penalty of 25%. Additionally, interest will be charged on the unpaid tax amount at the annual rate of 4% plus the federal short-term rate, compounded daily. It is important to note that penalty and interest rates can change, so it is advisable to check with the Arizona Department of Revenue for the most up-to-date information.

How do I edit az revenue online?

With pdfFiller, it's easy to make changes. Open your arizona revenue form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit az revenue form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share az property search from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit az property on an Android device?

With the pdfFiller Android app, you can edit, sign, and share 82162 form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your az revenue 2019-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Az Revenue Form is not the form you're looking for?Search for another form here.

Keywords relevant to arizona revenue property form

Related to arizona 82162

If you believe that this page should be taken down, please follow our DMCA take down process

here

.