CA CDTFA-95 2022-2024 free printable template

Show details

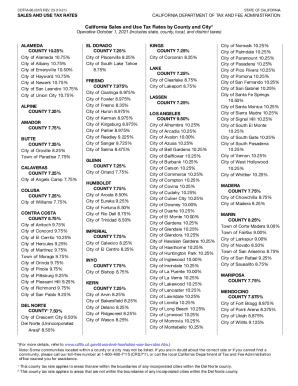

CDTFA95 (S1F) REV. 26 (1022)STATE OF CALIFORNIASALES AND USE TAX RATESCALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City×Operative October 1,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ca sales tax rates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ca sales tax rates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ca sales tax rates online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit california sales tax rates form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

CA CDTFA-95 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ca sales tax rates

To fill out CA sales tax rates, follow these steps:

01

Gather the necessary information: Collect all the relevant sales data, including the total sales amount and the applicable tax rates for the different goods or services you are selling.

02

Determine the tax rates: Consult the California State Board of Equalization or the California Department of Tax and Fee Administration's official website to find the current sales tax rates. These rates may vary depending on the location and type of product or service.

03

Calculate the taxes owed: Multiply the total sales amount by the applicable tax rate. This will give you the tax amount that needs to be collected from customers or paid to the tax authorities.

04

Record the sales tax amount: Keep accurate records of the sales tax owed for each transaction. You may need to report and remit these taxes regularly to the tax authorities, so it is essential to maintain organized records.

Who needs CA sales tax rates?

01

Business owners and entrepreneurs: If you own a business in California, whether it is a physical store or an online enterprise, understanding and applying the correct sales tax rates is crucial for compliance and accurate financial accounting.

02

Accountants and bookkeepers: Professionals responsible for financial management and accounting tasks need to be familiar with CA sales tax rates to ensure accurate calculation of taxes, proper recording, and reporting.

03

Government agencies and tax authorities: The California State Board of Equalization and the California Department of Tax and Fee Administration require accurate reporting and remittance of sales taxes. They rely on business owners and taxpayers to correctly determine and apply the appropriate tax rates.

04

Consumers: Being aware of CA sales tax rates can help consumers understand the total cost of their purchases and budget accordingly. It is essential for individuals to know the applicable sales tax rates to avoid overpaying or being undercharged for taxable goods and services.

Fill california sales tax rates : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out ca sales tax rates?

1. Visit the California State Board of Equalization (BOE) website at https://www.boe.ca.gov/

2. Under the “Sales and Use Tax” section, select the “Rates” tab.

3. Select the county or city you are looking for from the list of California counties and cities.

4. The page will provide a summary of the applicable state and local sales tax rates for the selected county or city.

5. The page will also provide detailed information on the state and local sales tax rates, including when they were last updated, the expiration date, and the applicable district taxes.

What is the purpose of ca sales tax rates?

The purpose of California sales tax rates is to generate revenue for the state government to fund public services such as education, health care and public safety. Sales tax is collected on most goods and services sold in California and is used to fund state and local government operations.

What is ca sales tax rates?

As of September 2021, the sales tax rate in California is 7.25%. However, it is important to note that local jurisdictions in California can also impose additional sales taxes, which can vary from county to county and city to city. The total sales tax rate can range from 7.25% to 10.50% depending on the location.

Who is required to file ca sales tax rates?

All individuals and businesses in the state of California who make sales of tangible goods, certain digital products, and some services are required to file and pay California sales tax. This includes both in-state sellers and out-of-state sellers who meet specific thresholds for sales into California.

What information must be reported on ca sales tax rates?

When reporting on California sales tax rates, the following information must be included:

1. Base Sales Tax Rate: The statewide base sales tax rate in California is currently 7.25%. This rate is applied to most retail sales of tangible goods.

2. District Taxes: California allows local jurisdictions, such as cities and counties, to impose additional sales tax rates. The reporting should include the specific rates for each district where the sale is taking place.

3. Total Sales Tax Rate: The total sales tax rate is the combination of the base sales tax rate and any applicable district taxes. This is the rate that consumers would actually pay on their purchases.

4. Exemptions and Special Tax Rates: Certain items may be exempt from sales tax or subject to special tax rates. Reporting should also note any unique tax rates or exemptions for specific types of products or services.

5. Effective Date: It is essential to report the effective date of any changes in the sales tax rates in California. This helps businesses and consumers stay informed about any updates or modifications in tax rates.

6. Additional Information: Depending on the purpose of the report, additional information such as the specific legislation that introduced or modified the sales tax rates, any temporary changes or exemptions, and any upcoming changes in the tax structure may be relevant.

It is crucial to refer to official sources such as the California Department of Tax and Fee Administration (CDTFA) or the specific city or county tax authorities to obtain accurate and up-to-date information on sales tax rates in California.

What is the penalty for the late filing of ca sales tax rates?

The penalty for the late filing of CA sales tax rates depends on the amount of tax owed and the length of the delay. Generally, the late filing penalty is 10% of the tax due if the return is filed after the due date. Additionally, an interest charge may be applied for each month the payment is late. It is advisable to consult the California Department of Tax and Fee Administration (CDTFA) or a tax professional for specific details and circumstances.

How can I modify ca sales tax rates without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like california sales tax rates form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I edit california sales use tax rates on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 2022 california sales tax rates, you need to install and log in to the app.

Can I edit california use tax rates on an iOS device?

You certainly can. You can quickly edit, distribute, and sign cdtfa 95 form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your ca sales tax rates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Sales Use Tax Rates is not the form you're looking for?Search for another form here.

Keywords relevant to ca sales tax form

Related to 2022 cdtfa 95

If you believe that this page should be taken down, please follow our DMCA take down process

here

.