QP/401(k) Separation From Service Distribution Request Form 2007-2024 free printable template

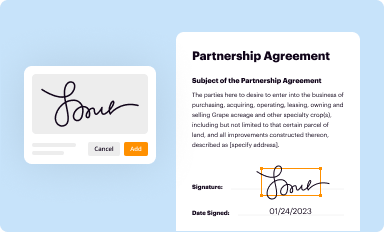

Get, Create, Make and Sign

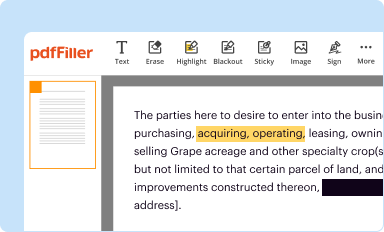

Editing paychex 401k withdrawal form online

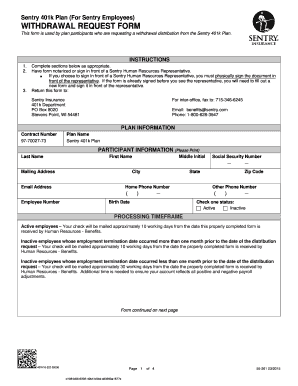

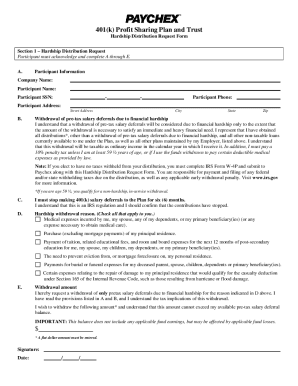

How to fill out paychex 401k withdrawal form

Who needs the Paychex 401k withdrawal form?

Video instructions and help with filling out and completing paychex 401k withdrawal form

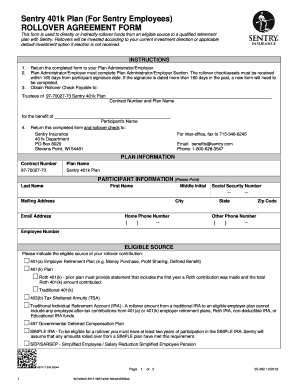

Instructions and Help about 401k rollover form

Okay congratulations you got your 401k establish you've established your checking account now it's time to start moving the assets into the retirement plan how do you do that well we've got a form for doing this and let's just walk through this step by step now first big warning on this form and the whole process many times your current investments will have surrender fees you need to make sure that you know what if any surrender fees are going to be due by moving these assets over to your brand-new self-directed retirement plan other issue to be aware of chances are your current custodian or your employer already has a form they want you to fill out in order to request those funds if that's the case by all means use the form you don't need to use this form other aspect whoever we set up the checking account with let's say as well as Fargo they aren't your custodian they aren't your third-party administrator their role is strictly to be the checking account provider for you so if your current custodian asks for Wells Fargo to sign something it's not going to happen you are the trustee of your 401k plan, and it's you who's gonna sign and provide that document final aspect you cannot roll over or transfer a Roth IRA into your 401k yes this 401k has Roth features, but you can only transfer a rollover a Roth 401k account into a Roth 401k account you cannot transfer a rough IRA into a Roth 401k so with all that let's just get down to the meat of the matter right up top we have participant information that you are the participant really simple stuff fill out your name up here your social security number your phone number fax number street address city state zip boom that was easy enough next fill in the information for the current custodian the current trustee whoever is currently holding the money or the assets of the retirement plan this is where their information goes, so you put in their name your account number with them and then put in their address information in this area then we get down to what you're asking them to transfer what are you going to ask for them to move directly to you well if you want to have them liquidate all the assets in the account and then just send you the cash go to area a to section a and what you would do is say please liquidate all assets in my account and either a why are the proceeds to the bank information below that's down here or mail a check using the information in Section C below that would be over here, so that's if you want them to liquidate everything and just move cash into the account you would then check this box, and then you would also select how you want the funds to get there either by wire or to have the mail a check section B this is if you only want to move a portion of the assets let's say that you got 200,000 sitting inside a retirement plan, and you only want to move 25,000 dollars you would say please liquidate $25,000 and why are the proceeds using the bank information below down here or...

Fill paychex 401k distribution request form : Try Risk Free

People Also Ask about paychex 401k withdrawal form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your paychex 401k withdrawal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.