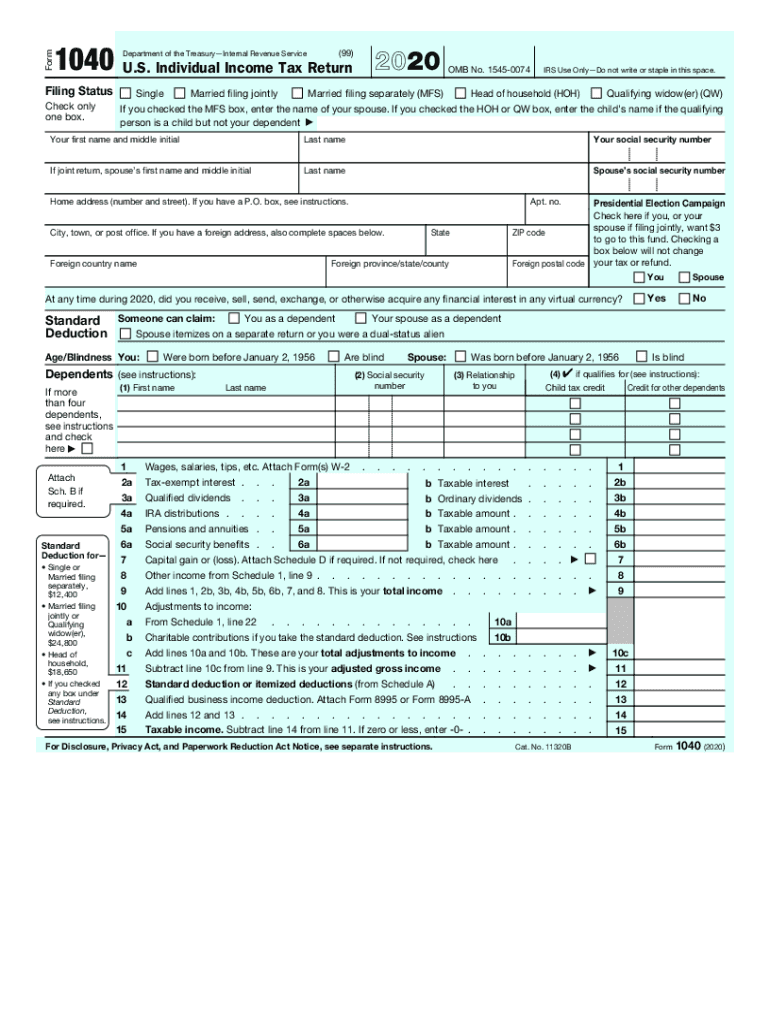

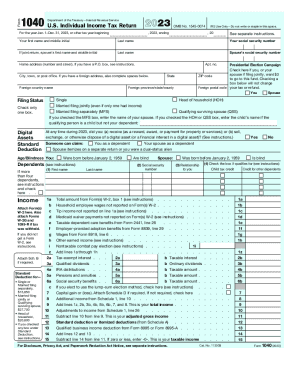

Who needs 2016 IRS 1040 form?

All US residents and citizens must file form 1040 known as the U.S. Individual Income Tax Return. Form 1040 is considered to be a standard form, but has a number of variations, each designed for particular group of taxpayers.

What is form 1040 for?

Form 1040 is an important document to be filed by all individuals to reveal their earnings for the year. This is done for three main reasons. First, it is important to find out how much tax should be withheld from the individual's earnings. Secondly, it is done to check whether the person should be given a tax refund. Finally, form 1040 is filed to see whether a taxpayer owes money.

Is form 1040 accompanied by other forms?

As a rule, form 1040 is followed by a W-2 form that an individual may get from the employer. Also, there are forms W-2G and 1099-R that must accompany form 1040 only if the tax was withheld.

When is form 1040 due?

Every individual must file form 1040 by April, 18, 2017.

How do I fill out form 1040?

In total, form 1040 consists of 79 lines. In 2016 some of these fields have undergone changes. Thus, before filing the form check:

-

Delivery service details

-

Electronic PIN information

-

The amount of educator expenses

-

Mileage rate

-

Itemized deduction amount in section tax and credits

-

Tax exemptions

-

Other taxes

-

Payments and refunds

Be attentive making calculations. Use instructions provided for each form.

Where do I send form 1040?

Once your form 1040 is completed, send it to IRS website.