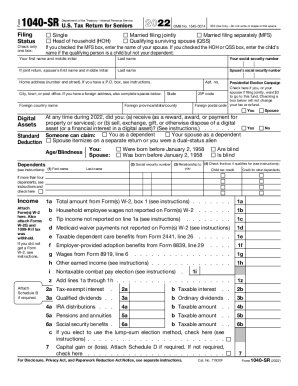

What is an IRS form 1040 SR?

The IRS form 1040 SR is equivalent to the 1040 federal income tax return sample and is for taxpayers aged 65 years and older. It contains the exact instructions as the standard 1040 form while emphasizing Social Security and other tax benefits for senior citizens. It also has a larger font size making it easier to read and complete.

Who should file the IRS form 1040 SR 2023?

All citizens born before January 2, 1957, should use the IRS tax form 1040 SR to declare their tax return. Other taxpayers should use the standard tax return template.

What information do you need when you file the IRS tax form 1040 sr?

The IRS form 1040 SR contains instructions on what information you should provide in your tax return document. Please read the directions and comments for each line carefully before completing it. You’ll need to provide details like your Social Security Number and information about your spouse and/or dependants. The IRS form 1040 SR requires taxpayers to report any transactions with virtual currency. You’ll also be required to provide the following:

- Information regarding all wages

- Tax-exempt interest

- Pensions

- Social Security benefits

- Other income received during the 2023

Carefully make calculations of your standard deductions. You can find the instructions for determining this amount on the last page of the template. Additionally, you can find guidance and recommendations on which document to fill out depending on your life situation on the Internal Revenue Service’s website.

How do you fill out the IRS form 1040 SR in 2024?

Internal Revenue Service allows taxpayers to file their tax refund either by mail or sent electronically. A paper-free option is faster and more convenient, as you can easily change and correct the data provided before you submit your sample.

Follow the guidance below on how to complete your IRS tax form 1040 SR online using the pdfFiller service:

- Click Get Form to upload your form to the document editor. Use the Fit Width option to zoom in and out, if needed.

- Complete the fillable fields using the Text, Check, and Date tools from the toolkit at the top.

- Navigate through the document using the Next key or use the Clear option to change your details.

- Check all information and click Sign to add your legally-binding electronic signature.

- Click Done and use the right-side toolbar to send your document via USPS or eFile it to the IRS right from the editor.

Is the IRS form 1040 SR accompanied by other forms?

You should accompany your IRS tax form 1040 SR with the 1099-R form completed by your employer (for those who haven’t reached the minimum pensionable age) and a W-2 form regarding your Income, Medicare, or Social security taxes withheld. Also, if you would like to get a direct refund from the IRS deposited to your account, complete and attach form 8888.

When is the IRS tax form 1040 SR due?

The closing date for senior citizens to submit their IRS form 1040 SR is April 18, 2024. If you need more time to fill out and send your tax refund document, you can submit form 4868 by that date to get an extension. Still, you must pay your taxes by the original deadline to avoid penalties for late payment.

Where do I send an IRS form 1040-SR?

You should file your IRS tax form 1040 SR to the Internal Revenue Service department via the USPS service. pdfFiller provides you with an easy-to-use document filing option.